Strategic advice and outsourced CFO

Advimotion is your right-hand man in charge of the finance function. As a startup-oriented CFO, we prepare you for fundraising and/or assist you in managing the financing received.

As a true long-term partner, Advimotion will help you grow your company.

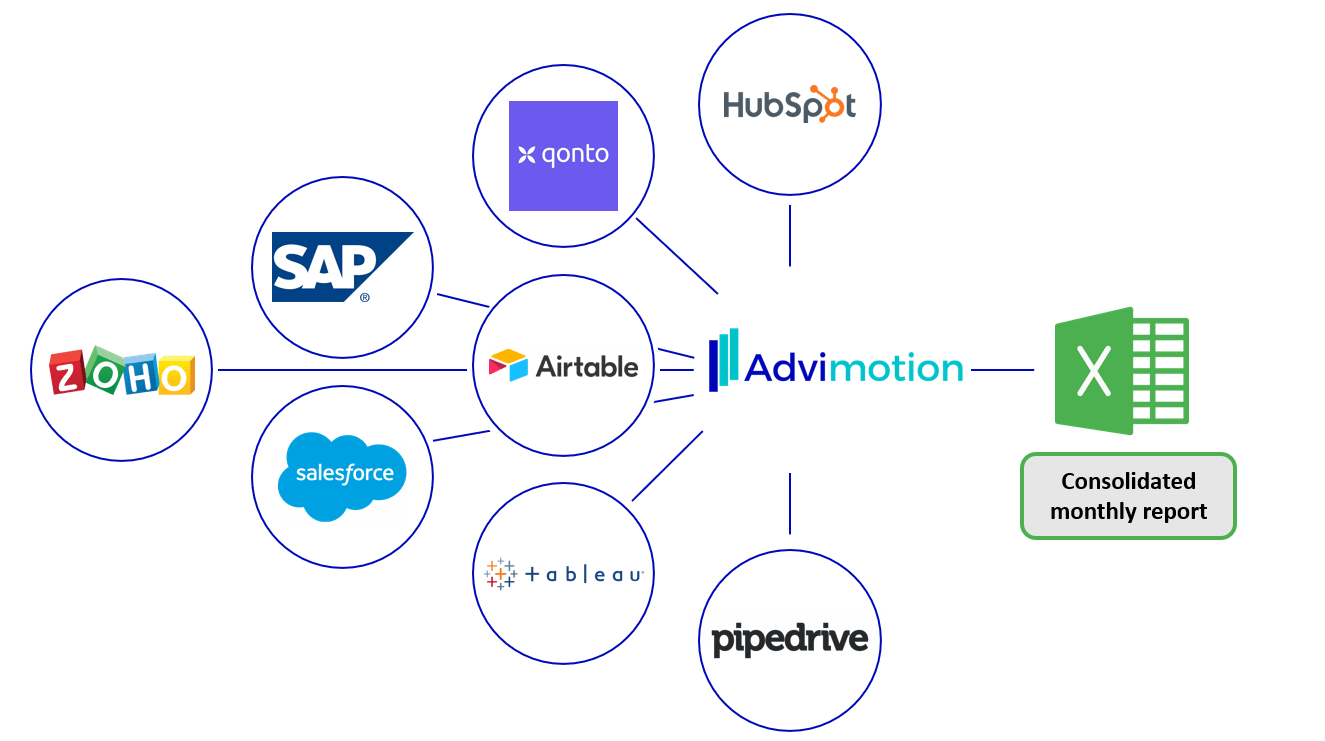

A "data oriented" follow-up

We use all your company's data to provide the best possible financial and operational follow-up.

What we use

Banking data : cash monitoring, expense analysis

CRM and billing tools : sales pipeline, churn, sales conversion rate

Marketing tracking tools : acquisition costs, marketing budget efficiency

Our methodology

1. Writing of the business plan and financial forecast

We make financial projections over 3 years (projected income statement, balance sheet, projected cash flow…) in order to keep a medium/long term vision. We also draw up budgets in order to anticipate any cash flow problems.

2. Regular monitoring and profitability analysis

We analyse your company's financial situation (process, cost and results analysis) and identify any discrepancies that appear between forecasts and reality in order to understand and be able to explain the results obtained by the company.

3. Strategic advice

We help you to judge the effectiveness of your strategic choices and the possibilities of pivoting with a view to improving your profitability.

4. Search for financing

We contact potential investors (investment funds, banks, business angels) and carry out the necessary financing research.

5. Reporting to investors

We manage the relationship between your company, banks and investors by providing the requested financial documents.

Case studies

Case study 1: Acquisition strategy

For an IT company, we analysed acquisition costs by customer and service categories. We have enabled the company to better distribute the resources allocated to customer acquisition

Case study 2: Investor relations reporting

For a technology company in the entertainment sector, we set up reporting tools. Thanks to the selection of relevant KPIs and the automation of processes, investors were satisfied with the quality of the information shared and the speed of reporting

Case study 3: Partnerships Start-up – major corporation

We assisted a service company in the implementation of a new business model to generate recurring revenue. The management of the accompanied start-up was able to conclude two contracts with major groups and convince investors to raise seed money

Schedule a phone call

You can schedule a call back to learn more about our services and how we can help you.