The investor pitch deck is a document of about ten to twenty pages that allows startups to present their project to potential investors in the context of a fundraising. The pitch deck is therefore an essential and indispensable step for all project leaders. Here is what you should do or not do to succeed in your fundraising pitch deck !

Advimotion is a financial consulting firm that assists startups and SMEs in obtaining non-dilutive financing and equity fundraising. We also act as advisors in corporate divestiture transactions to best represent the interests of sellers.

We offer strategic consulting and outsourced CFO services to ensure the financial and operational monitoring of your business. Finally, we take care of the drafting of investor documentation : business plan, pitch deck, creation of reporting files and valuation calculations.

For more information, please contact us.

Grabbing investors’ attention : DO

It is essential that your investor deck pitch interests your audience from the very first minutes. You need to create a certain chemistry with your audience. It is obviously not possible to seduce everyone, but you can already take the time to get interested in each of them. Don’t waste too much time, however, as investors often have a busy schedule. Alternatively, you can simply ask a simple question at the beginning of your pitch and then use a tagline that summarizes your project and answers the question directly. This is obviously just a tip that you don’t have to follow.

The most important thing is to have the attention of investors from the beginning to the end of your pitch deck!

Fake it : DON’T

It is essential that when you present your pitch deck, you are yourself. You should not play a role to try to please. Your investors should get a glimpse of your company’s culture, the skills and personalities that make up your team, and the ambitions and visions of your project through your pitch deck. You should also not copy your pitch deck from others. Although it sounds easier, you won’t really be able to demonstrate the uniqueness of your startup.

Mastering the subject of the investor pitch deck : DO

It is essential that you know your project and the market you are targeting. You must be able to answer the investors’ questions. Some are quite obvious, easy to prepare, while others will be much more technical. This will also show your interlocutors that you know what you are talking about. This will make you more credible.

Giving too much information : DON’T

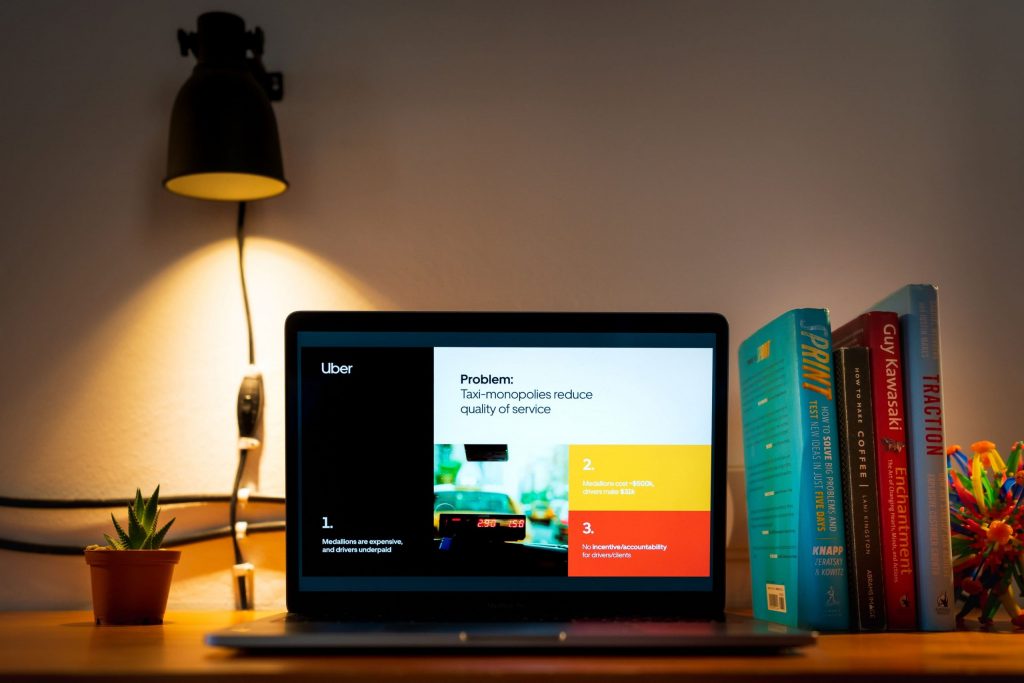

It is essential that your investor pitch deck is clear, precise and succinct to make investors want to finance your project. A pitch deck that is too long, too rich in information and too exhaustive risks boring investors. Some investors, like Guy Kawasaki, advise composing a pitch deck of 10 slides with a font size of 30, which only requires 20 minutes of oral presentation. As you can see, a simply organized presentation is always better than one that is too detailed. This is why it is strongly advised to build the skeleton of your pitch deck beforehand. Moreover, you should regularly rework it, adjust it and calibrate your ideas and arguments.

Make a clear presentation of the business model : DO

It is essential that your pitch deck reveals how your startup plans to achieve its goals. While keeping it simple, you must demonstrate the profitability and viability of your project in order to capture the attention and understanding of your audience. The presentation of your business model does not have to last forever. However, it is essential to prepare it well because it is considered the most important slide by many investors. Be careful not to confuse the business model with the business plan !

Falsifying information in the investor pitch deck : DON’T

It is essential that all the information presented in your investor pitch deck is true, because an investor will always get to the truth. Therefore, avoid embellishing certain figures in the hope of raising funds. It will only make you lose credibility. You will not succeed in getting new funds and building a good reputation for your startup with investors for future resale of the shares when you have realized a capital gain.

An impeccable attitude with the investor pitch deck : DO

Be spontaneous! In spite of the training and preparation you have done, you should be free to be spontaneous between two well-prepared presentations. This will bring more naturalness to your presentation and create a better connection between you and those who are listening to you. Of course, we strongly advise against reciting your speech by heart. Fluency in speech is more effective and is better perceived than a speech recited by heart. So we recommend that you be spontaneous and possibly improvise part of your speech, but absolutely not the whole thing, which can be very risky.

It is imperative to use clear and precise vocabulary that will speak to your audience. Using technical terms related to your project and activity will not make you look like an expert and may even work against you by causing misunderstanding among your interlocutors. You must at all costs banish technical and complex terms in favor of a simple vocabulary to understand.

The way you express yourself counts! You must take the time to articulate well in order to be correctly understood by the interlocutor. To do this, your speech rate should not be too fast and should average 150 words per minute.

Find us on Medium if you want to keep reading.

Advimotion, your growth partner.