The pitch deck to raise funds must be done with great care. Indeed, it is on this support that potential investors will rely to make a decision to enter the capital of the startup.

Nowadays, the pitch deck is based on precise codes. Indeed, in powerpoint format, the pitch deck includes about ten main slides which are :

- The introduction : name of the startup and its logo

- The market issues : what are the problems you have identified ?

- The solution that the startup brings to solve the identified problems

- Market size : how big is the market ?

- Competitive analysis : who are your competitors ? What do they have that is similar and different from you?

- Unique value proposition : what differentiates your startup from other startups ? What makes you unique and special?

- The business model : who do you sell to and how do you make money ?

- More details about the product or service features

- The team : who are the key members of your team ?

- Financial projections and key metrics: what are your revenue projections? How quickly do you expect to reach profitability?

- Use of funds : how will the startup allocate the funds provided by investors?

Sub-slides complete these main slides. Therefore, the pitch deck can reach a maximum of 30 slides.

Advimotion is a financial consulting firm that assists startups and SMEs in obtaining non-dilutive financing and equity fundraising. We also act as advisors in business sales transactions to best represent the interests of sellers.

We offer strategic consulting and outsourced CFO services to ensure the financial and operational monitoring of your business. Finally, we take care of the drafting of investor documentation : business plan, pitch deck, creation of reporting files and valuation calculations.

For more information, please contact us.

The pitch deck for raising funds follows the entrepreneur at each meeting with potential investors. Thanks to this presentation, investors should understand in about 30 slides the core business of the startup. In addition, the added value is explained.

The main slides

The main slides are :

- The introduction : a simple slide where the startup’s name and slogan appear.

- The market issues. Investors will be able to discern if it is a real problem. Indeed, today, many entrepreneurs want to raise funds without solving a real problem.

- The solution that the startup brings to solve the identified problems : this is to describe how the problem will be solved.

- Market size : how big is the market estimated to be ? This slide is very important because, by convention, investors focus on global markets above 1 billion euros.

- Competitive analysis : who are your competitors ? What do they have that is similar and different from yours ? Entrepreneurs like to say that they have no competitors or that they are alone in their market. However, knowing that there are competitors reassures investors. It is proof that the market exists and that your startup is not in a first-mover position in the market. Indeed, the position of first entrant on the market is double-edged. Either the startup finds traction right away, or it makes too many mistakes or does not find its target market and disappears. To avoid this risk, investors prefer to know that there are already competitors in the target market.

- The unique value proposition : what makes your startup different from other startups ? What makes you unique and special ? A startup is not supposed to copy what its competitors are doing, it has to bring a different touch, no matter how small.

- The business model : who do you sell to and how do you make money ? What are your compensation models. Is it retail or a subscription service ? Are your customers businesses (B2B), individuals (B2C) or government (B2A) ?

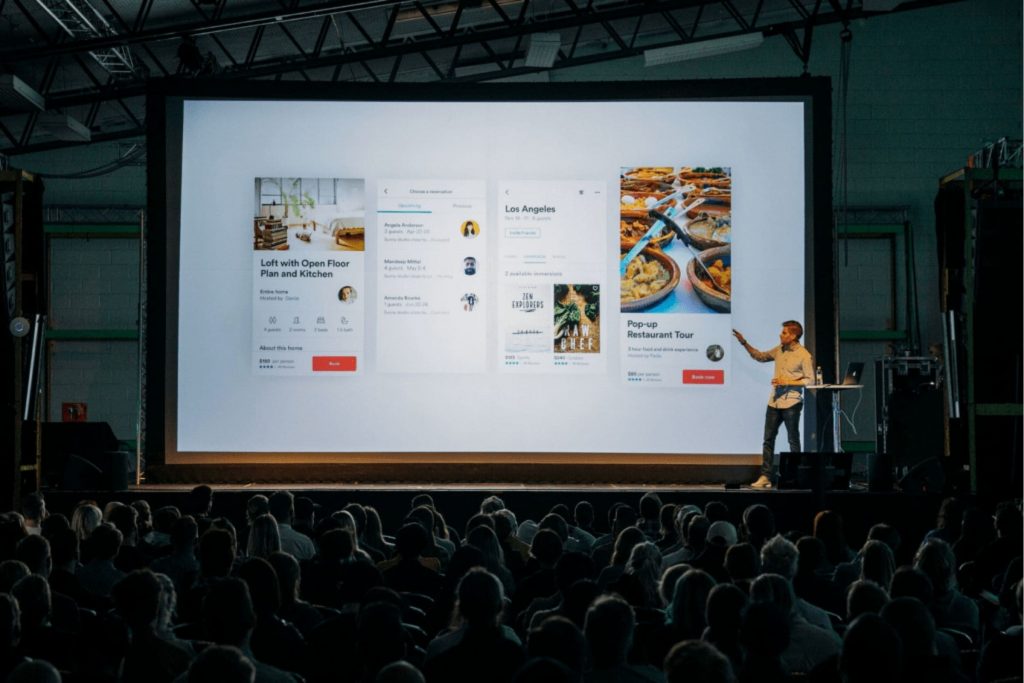

- More details about the product or service features : On this slide, you should show the features of your product or service.

- The team : Who are the key members of your team ? What is their academic and professional background ? What skills have they developed?

- Financial projections and key metrics : what are your revenue projections ? How long do you expect to break even and then be profitable ? Investors who expect a return on investment in the medium to long term (5-8 years) are interested in these financial issues. This is why you should take the time to make assumptions about the growth of your business over the coming years. Be careful in this part not to be too optimistic or too pessimistic about the figures in order not to scare away investors.

- The use of funds : how will the startup distribute the funds given by investors ? How much of it will go to HR, marketing or R&D ? To summarize, we simply describe the use of the money.

Slides related to the entrepreneurial project

However, some slides are not mandatory. Their appearance in the pitch deck depends on the activity of the startup. These slides are :

- The Go-to-market : how will the startup reach the final customer ? What are its marketing and communication strategies?

- The contact : how to easily contact the founders

The shape of the pitch deck

Consequently, the pitch deck must also respect a certain formalism in terms of form. The format must be uncluttered, visual (with as little text as possible), and respect the same graphic charter throughout the presentation. These are small details of presentation but they count a lot because they help to hold the precious attention of investors.

So, you now know everything that a pitch deck must contain to convince investors. Take the time to make it right because once it is done, it can be distributed to several people. If you want your pitch deck to be made by a professional in fundraising documentation, do not hesitate to contact us.